creates trust

where none exists

augments trust

where it has been impaired

creates investible instruments

from real-world assets

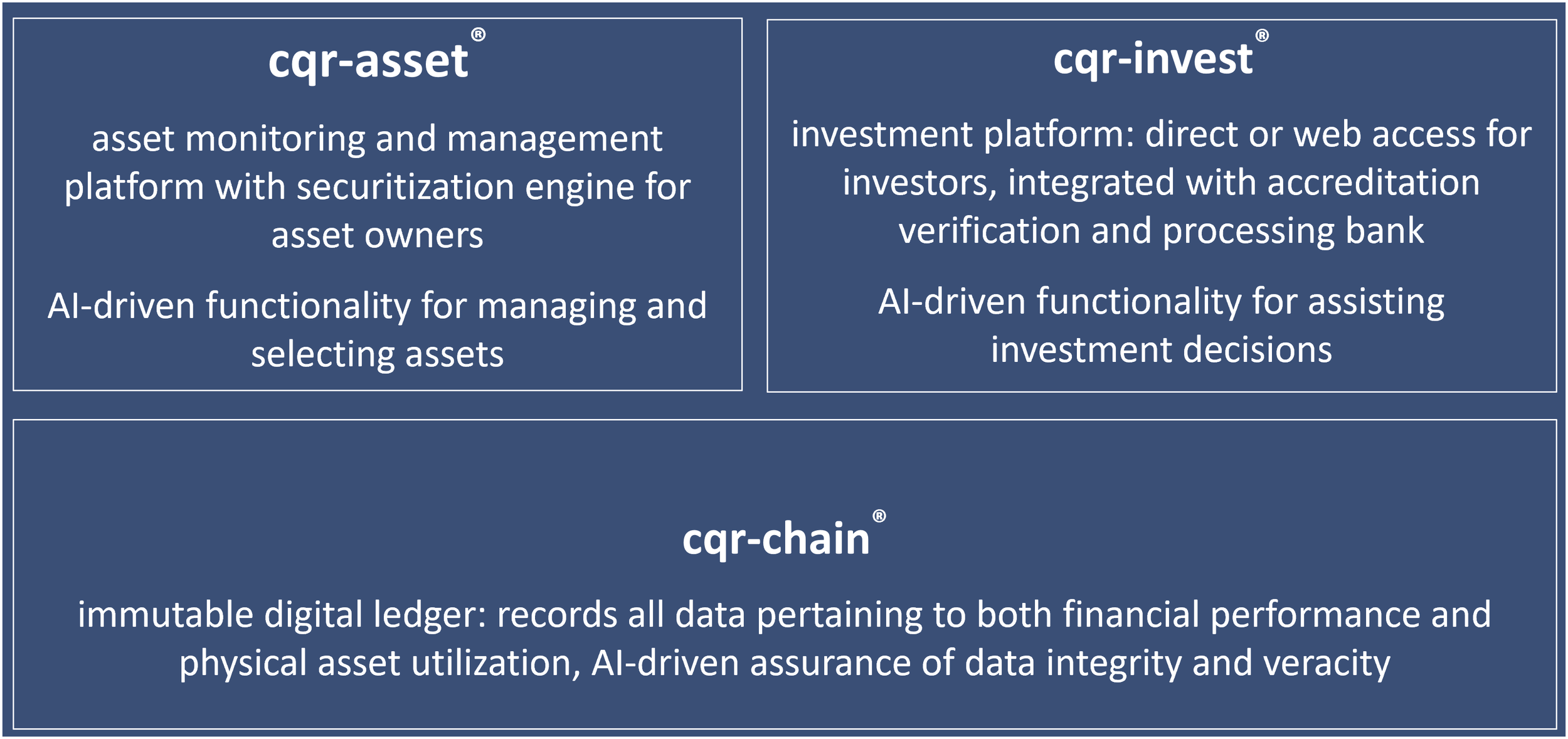

cqr-invest®

cqr-asset®

cqr-chain®

end-to-end non-mortgage asset-backed securitization (ABS) platform

for both emerging and industrialized markets

cementing trust in asset backed securities

Non-mortgage commercial Asset-Backed Securities (ABS) are a cornerstone of institutional fixed-income portfolios, with around $4 trillion of annual global issuance (listed and unlisted) and $1.7 trillion in US listed securities outstanding in 2023.

These securities are backed with the cashflows received from services such as energy generation or equipment leasing. The underlying installations and equipment, with stable and predictable value, serve as collateral—resulting in relatively low default risk compared with, for instance, mortgage-backed securities, where real-estate price swings can pose a significant risk.

widely accepted — in need of verification

Historically, non-mortgage ABS have been created for large institutional investors, centered on sizeable portfolios of high-value assets in mature markets. Their reliability rests on well-defined characteristics and well-established reporting standards.

Today, that trust is eroding, revealing the need for more transparent verification. At the same time, issuers in emerging markets lack the infrastructure that underpins trust in mature systems, leaving the ABS market largely inaccessible to them.

cathmere’s proof-based platform

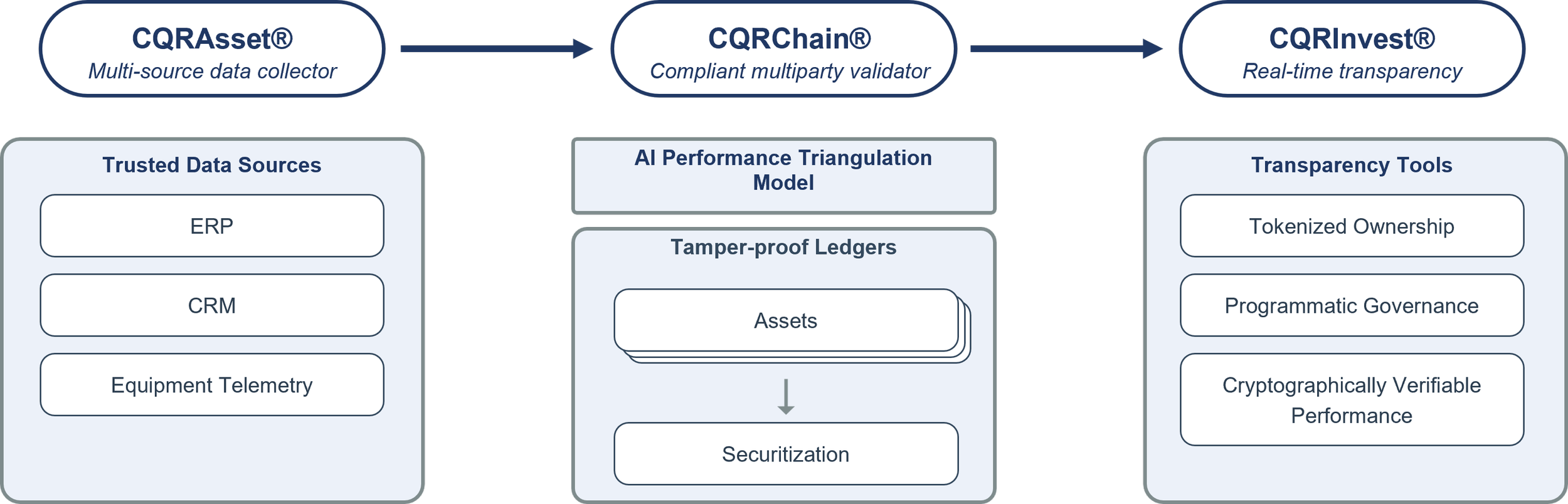

Cathmere establishes trust through technology. Using blockchain, IoT, and AI, the platform provides mathematical proof as it creates immutable links between contracts, payments and physical assets, drawing verified data directly from the source, and submits the data to continuous quantitative review.

for advanced and industrialized markets

Integration with manufacturers’ telematics platforms—covering equipment and power-plant components—simplifies the refinancing of vendor leases and vendor-financed portfolios.

Recent irregularities in the US ABS market have shown how weak asset verification can compromise even the most mature systems. Cathmere’s architecture makes vulnerabilities such as fraudulent duplication virtually impossible.

for emerging markets

In high-growth economies, Cathmere’s platform bridges the trust gap, enabling issuers to structure asset-backed securities that meet the standards of investors in advanced markets. It also opens participation to accredited retail investors, expanding access to a vital source of capital.

trust architecture

verifiable and immutable

a transparent investment platform

for securitizations

for a better world

for all investors

for all vendors

a powerful platform, for both traditionally issued and tokenized securities

Powered by CQR-CHAIN®, Cathmere delivers comprehensive, audited, real-time data transparency—linking asset performance directly to investors through cqr-invest®, while asset-owners and issuers have access to their portfolios through cqr-asset®. The securities (investible instruments) are either issued traditionally, or in tokenized form.

allowing (accredited) retail investors to participate in the abs market

Through CQR-INVEST®, accredited retail investors will be able to invest in asset-backed securities and enjoy the benefits of these securities typically reserved for institutional investors.

providing manufacturers and large asset owners with visibility and direct access to capital markets

Asset-owners such as manufacturers (OEMs), energy project developers and leasing companies have direct access to investors through Cathmere’s platform, and full visibility on the performance of both the contracts and the physical assets through CQR-ASSET®.

untapped potential in emerging markets

Emerging markets hold enormous promise: growing populations, accelerating urbanization, abundant natural resources, passionate entrepreneurs, and increasingly skilled workforces. These economies also play a critical role in mitigating climate change. Yet too often, growth and climate goals are constrained by limited access to suitable financing—particularly the lack of viable pathways for refinancing debt.

yield alignment

While emerging markets face a funding shortfall, investors in mature economies struggle to find low-risk assets with sufficient yield to meet portfolio objectives. Institutional investors are seeking suitable instruments that align yield generation with positive impact.

bridging two sides of the global capital divide

Cathmere is building the bridge between high-impact opportunities in emerging markets and sophisticated investors seeking secure, yield-bearing exposure.

turning real assets into investable instruments

eliminates market opacity

provides automated verification of (physical) asset existence

allows continuous asset performance monitoring

creates investable instruments (securities), both traditional and tokenized

offers transparency to issuers and investors

creates dynamic, interoperable financial instruments

enhances liquidity

in-house developed

proprietary technology

combining

blockchain, AI, and IoT

(patent pending)

technology stack

our technology stack addresses five critical dimensions of the securitization lifecycle, each protected by proprietary methods and systems that create substantial competitive moats

Our provisional patent application includes innovations that:

transform blockchain into a real-time asset monitoring system

provides complete transparency to investors while protecting commercially sensitive data

reduce counterparty complexity

grant data access to tokenized securities

automatically trigger distribution across multiple blockchain networks

team

Cathmere’s founding team brings decades of experience in early-stage investment, technology-led new venture creation, financial markets, business building in global markets and management.

-

Founding CEO

In addition to serving as CEO of Cathmere, Frans is Chair of African Asset Finance Company, Inc., and serves on a number of affiliated company boards.

Previously Frans founded Tribute Capital, was a managing partner at Logispring, served as (interim) CEO of a number of industrial groups, and was a junior partner at Gilde Investment Funds. He has (co-)founded several businesses including some equipment leasing companies.

-

VP Software Engineering

Matt is a seasoned engineering leader and entrepreneur with 25 years of experience building high-performing teams and bringing new software technology and products to market in the US and globally in highly regulated industries including finance, medical and military/defense.

Prior to joining Cathmere, Matt led the design and implementation of Blockchain Regulatory and Compliance Technologies at Paxos. His prior experience also includes senior technology leadership positions at Canonical and Northrop Grumman.

-

Senior Software Engineer

Kjell-Erik is a senior blockchain engineer and researcher specializing in blockchain interoperability and digital assets, with experience from high-profile central bank digital currency and programmable financial market infrastructure projects.

Previously, he served as Senior R&D Software Engineer at Quant Network, where he was responsible for, inter alia, blockchain interoperability, central bank digital currency, tokenization, and programmable money.

Prior to Quant, he served as Head Software Engineer at the University of Bergen where he focused on blockchain for healthcare and scientific (climate change) data.

-

Senior Software Engineer

Kirill is an engineering leader specialized in building data-intensive systems at the intersection of traditional software engineering and machine learning.

Previously, he was a Senior Software Engineer at BANYAN (acquired by Bilt) where he was responsible for building mission-critical data systems on Google Cloud, natural language-to-SQL interfaces, and data visualization portals serving enterprise clients

Priorr to Banyan, he was a Senior Software Engineer with MediaMath Intelligence Team, where he focused on ML models processing millions of daily data points, and analgorithmic trading tool.

Before MediaMath he was a Lead Software Engineer at Octane11 where he was responsible for a full-stack development integrating multi-channel advertising data, and an advanced analytics dashboards on GCP with Kubernetes

-

office manager

Christine has been involved with Cathmere from the moment she joined AAFC as executive assistant in early 2023, and formally joined Cathmere a year later.

Previously, Christine worked for more than fifteen years in several departments at Goldman Sachs and at Bank of America, with roles ranging from project lead to senior executive assistant.

-

senior technology advisor

Brad is an experienced growth technology executive, having served in strategic, investment and operating roles. He translated the original ideas for Cathmere’s platform into an architectural framework that the team is now using to build the platform.

He currently serves as the Chief Strategy Officer of Methode Electronics (NYSE: MEI) and previously led the creation of the Fleet Solutions business unit of Stoneridge (NYSE: SRI). As the founder and principal of Princeton Management Associates, Brad performed strategy, and advisory roles for many growth companies, including Quality Health (sold to RealAge), Confidex (sold to Beontag) and Steerpath (a leading provider of indoor location and wayfinding technologies).

Brad was Strategy and Technology partner at the industrial innovation investor Logispring, and a Principal in Booz Allen Hamilton’s Information Technology group.

Join the team

Cathmere is seeking experienced senior developers, business analysts, and specialists in the areas of (social media) marketing, investor relationships, partnership development and origination

cathmere

building the infrastructure of trust

from concept to global fintech

Cathmere Inc is a US fintech start-up spun out of AAFC (African Asset Finance Company Inc), emerging from stealth mode in Q4 2025. Headquartered in the US with a presence in the UK, Cathmere will be expanding investor-facing operations to the EU, Dubai, Singapore, and Hong Kong, supported by origination and integration teams across key markets where the assets are.

partnering across the capital ecosystem

Cathmere works with intermediary banks and wealth management platforms to reach both institutional and accredited retail investors through a collaborative, fee-sharing model that is accretive to our partners.

integrating with the real economy

Cathmere is actively working with OEMs to integrate its systems with their telematics platforms, streamlining asset data flows for financing and securitization. Cathmere expects to formally launch operations with its first issuance in H1 2026.

ownership and capital partners

Cathmere is majority-owned by its founding team and is currently in discussions with venture capital investors interested in participating in its next phase of growth and value creation.